Updates Archive

Legislative Session Summary

April 19, 2018

Your Kentucky General Assembly has completed the 2018 Regular Session. With so many difficult problems to work on, it has been a challenging few months. I very much appreciate your input, and understand that it was hard to keep up with at times. For now, here is an alphabetical list of major legislation that becomes law this year.

Adoption and foster care. Unfortunately, sometimes after children are born, they may languish in foster care without a family for years through no fault of their own. House Bill 1 reforms Kentucky’s foster care and adoption system and will ensure that a child’s time in foster care is limited and that children are returned to family whenever possible.

Bourbon and breweries. In recent years, Kentucky has made numerous strides in both the craft beer and bourbon industry. Both industries provide thousands of jobs for our state’s economy and billions of dollars in economic impact. This year, the General Assembly decided to give back to those industries. House Bill 136 will increase what breweries can sell onsite to three cases and two kegs per customer. Another portion of the bill will allow breweries to sell one case per customer at fairs and festivals in wet jurisdictions. House Bill 400 will also allow for distilleries (and wineries) to ship a limited amount of the bourbon they craft.

Budget and tax reform. House Bill 200 will guide state spending for the next two fiscal years. The plan fully funds, for the first time, the state’s main public pension systems at the levels recommended by actuarial analysis. The budget plan will boost base per-pupil funding for K-12 education to a record level of $4,000 per student in each fiscal year. It also includes more than $60 million in new revenue to help implement proposed adoption and foster care reforms and tens of millions of dollars to hire more social workers. House Bill 366, which will fund the budget, includes a tax reform package that will generate about $400 million in additional revenue over the next two years. The plan include a 50 cents cigarette tax increase per pack and an expansion of the state sales tax to some services, such as landscaping, janitorial, laundry, and small-animal veterinary services. Significantly, it will also create a flat 5 percent tax for personal and corporate income taxes in Kentucky. The inventory tax will be phased out over a four-year period.

Death benefits. Police and other state employees are among the bravest in our communities, oftentimes risking their lives, and sometimes losing their lives in the line of duty. When they die, they may leave behind a spouse or children who now may worry about financial security. With House Bill 185, the spouses of a state employee who paid the ultimate sacrifice will get 75 percent of the workers’ salary paid to them monthly. The payment to widows already collecting will be increased to the new benefit.

Drones. Drone usage has become a fun hobby for some, but sometimes they are used for wrongdoing. House Bill 324 would prohibit the usage of drones over important infrastructure sites, such as power plants and military bases, unless permission is obtained. The bill would protect important Kentucky facilities against industrial spying.

Dyslexia. Every student in Kentucky should have access to a high quality and fair education, no matter any disability they may have. House Bill 187 will require the state Department of Education to make a “dyslexia toolkit” available to school districts to help them identify and instruct students who display early characteristics of dyslexia.

Gangs. Gangs are a growing problem in our state, particularly in urban areas. House Bill 169 creates penalties for criminal gang-related crimes, especially those involving gang recruitment. For example, the bill will make gang recruitment a felony instead of a misdemeanor for adults and make minors involved in gang recruitment face felony charges in certain cases. It will also expand the definition of what a gang is.

Life skills. Today, many of our younger Kentuckians struggle with skills they will absolutely need when they enter the workforce. Skills such as showing up to work on time or remaining drug free. House Bill 3 would encourage these workplace basics to be taught in schools across Kentucky.

Picture Privacy. House Bill 71 will increase penalties for posting sexually explicit images online without the consent of the person depicted. This is also known as “revenge porn.” The crime would be a misdemeanor for the first offence and a felony for subsequent offences. Penalties would be even more severe if the images were posted to make money.

Privacy in police camera footage. More and more police agencies are using body cameras to promote transparency. However, there are numerous times when police handle matters that are private and should remain private. House Bill 373 will exempt some police body camera footage from being publicly released. Examples include footage that shows the interior of private homes, hospitals, women’s shelters and jails, dead bodies, evidence of sexual assault, nude bodies, and children.

Protecting the unborn. I am proud to support the lives of the unborn. House Bill 454 will stop a violent type of abortion procedure, known as a dilation and evacuation, if a woman is more than 11 weeks pregnant. The law does not ban other types of abortion procedures.

Public pensions. After decades of being underfunded, Senate Bill 151 will make changes to Kentucky’s public pension systems that face more than $40 billion in unfunded liabilities. Changes proposed by the pension reform legislation include placing future teachers in a hybrid “cash balance” plan rather than a traditional benefits plan and limiting the impact of accrued sick leave on retirement benefit calculations. Kentucky’s unfunded pension liabilities have pressed funding for other important government programs and services for years, and the burden is still on the rise. This plan will set Kentucky on the financial track to solvency in public pensions to ensure checks for retirees continue while also reducing the impact on other critical government-funded programs.

Road Plan. House Bill 202 will authorize over $2.4 billion for bridges, repaving, and other highway needs throughout Kentucky over the next two fiscal years. Kentucky has a tremendous backlog in road projects that need to be finished and this plan will begin reducing that backlog.

Teen marriage. Senate Bill 48 will prohibit anyone under the age of 17 from getting married. It would also require a district judge to approve the marriage of any 17-year-old.

Terrorism. Senate Bill 57 will allow a person injured by an act of terrorism to file a claim for damages against the terrorist in state court.

Workers compensation. Kentucky’s workers’ compensation is antiquated and was in serious need of updating before this session began. House Bill 2, among other things, would make workers’ compensation medical benefits payable to certain permanently partially disabled workers beyond 15 years if a state administrative law judge deems the benefits necessary. The bill would also add to the list of injuries for which benefits must be paid as long as there is a disability, among other provisions. Finally, it would extend the period for all workers’ comp income benefits to age 70 or four years after the date of the injury, whichever comes last.

Other legislation that passed included:

Abstinence Education. Senate Bill 71 will require the inclusion of abstinence education in any human sexuality or sexually transmitted diseases curriculum in Kentucky high schools.

Bicycle safety. House Bill 33 will require drivers to keep vehicles at least three feet away from bicyclists during an attempt to pass. If that much space isn’t available, the driver must use “reasonable caution” when passing cyclists.

Financial literacy. House Bill 132 will require Kentucky high school students to pass a financial literacy course before graduating, once again emphasizing life skills.

Handicapped placards. House Bill 81 would allow disabled people to get a handicap parking placard for free, but it would cost $10 to get a replacement.

Jail security. House Bill 92 will allow jail canteen profits to be used for the enhancement of jail safety and security.

Organ donation. House Bill 84 will require coroners or medical examiners to release identifying and other relevant information about a deceased person to Kentucky Organ Donor Affiliates if the person’s wish to be an organ donor is known and the body is suitable for medical transplant or therapy.

Prescription medicines. Senate Bill 6 will require a pharmacist to provide information about the safe disposal of certain prescription medicines, such as opiates and amphetamines.

Putting our Pensions on a Stronger Path

April 2, 2018

Legislation to put Kentucky’s pension systems on a stronger trajectory passed the General Assembly on Thursday. This measure puts the retirement of our teachers, law enforcement, and state workers on sounder footing, and is based heavily on the input and concerns of these valued public servants.

We did not continue to kick the can down the road, as many wanted us to do. We took action to confront this crisis. It is a crisis because Kentucky has had one of the worst managed and worst funded pension plans in the United States. Our plan establishes a sound funding formula that ensures future General Assemblies will fully fund the pensions, and puts future hires into a defined benefit, hybrid cash-balance plan.

The hybrid plan, which new state employees hired since 2014 have entered into, has many benefits that future employees will receive. In fact, it is likely that future employees will have more money for their retirement under this hybrid plan than in the traditional defined benefit plan. Analysis shows that, using economic circumstances and past market trends, participants would have an average of 78% of their income replaced in retirement. Currently, it is just 71%. This plan allows participants to realize increases in the stock market, while also protecting investments from any market downfall.

Further, this plan does not reduce benefits for any current employee. I cannot emphasize this enough, as well as how much this differs from the other proposals. Cost of living adjustments for teachers will remain at 1.5%, and the provision requiring teachers with less than 20 years of service to work longer in order to receive enhanced benefits was pulled. Teachers are not required to stay in the classroom any longer before they can retire and their end-of-career benefit enhancements (High 3 / 3.0 factor) remains in place.

The only change for current teachers is that sick days accumulated after January 1, 2019 cannot be used as service credit for retirement moving forward. However, teachers can apply any days they have accumulated up until that point to their years of service for retirement and can continue to get paid for those sick days in accordance with their local district policy. This change was suggested directly by the Superintendents’ Shared Responsibility Plan—a measure supported by the Kentucky Education Association (KEA). Again, teachers can still use their existing sick days to enhance their final year of compensation when they retire. It is important to note; no teacher will ever lose a sick day and he or she will not be forced to retire to use their existing sick days for retirement. Teachers will still be able to cash-in sick days earned after January 1, 2019 at retirement and receive a check for them.

Also, much is being made about the supposed $5,000 reduction in death benefits for beneficiaries of state employees. This is a talking point from those who simply want to score political points off of our public servants, and neglects to mention that this was replaced with a $20,000 life insurance policy. However, the death benefit does not change for those currently invested in the system. Moving forward, this change not only provides a higher benefit, but it is not taxable income as the $5,000 benefit is.

This is a well thought out plan that has been heavily analyzed and scrutinized. It was not rushed, as this legislation has been in the public eye for weeks in the form of Senate Bill 1. I would not have voted for anything that I hadn’t read, and the committee substitute simply removed the provisions outlined above from SB 1. While it was not ideal for this legislation to be attached to another bill, this was the only way to proceed on saving the pension system this late in the legislative session. The Actuarial Analysis for this legislation is posted online, in the form of House Committee Substitute 1 to Senate Bill 151.

Internal meetings have taken place since April of 2017 to talk about the best way to approach this crisis. There have been public meetings since June discussing the steady decline in pension funding over time. I have taken the suggestions I have heard back from teachers, superintendents and public employees back to Frankfort to discuss with my colleagues at every step. I take this crisis seriously and am dedicated to fixing the pension system and providing a strong retirement for all public employees. The pension reforms enacted by the General Assembly ensure that the core retirement benefits of every current public employee are protected, and new public employees will have a safe, sustainable retirement income in the future.

I will continue to push for full pension and education funding in the budget, which we will be finalizing in the coming days. In the meantime, I hope that you will reach out to me with your questions, comments, and concerns. It is an honor to serve you in Frankfort, and I would be happy to answer any questions that you may have. Reach out to me at Kimberly.Moser@LRC.KY.GOV, or on the LRC message line at 1-800-372-7181.

Teachers’ Retirement System (TRS)

- No change of any kind to retiree pensions

- TRS COLA Adjustments (Future Retirees): No change for current members and retirees (1.5% COLA remains as currently provided in statute).

- TRS Current Members:

- No change to Inviolable contract

- No changes to High-3 Final Average Salary/3.0% benefit factor.

- No adjustment to employee contribution to fund retiree health.

- Limits the impact of sick leave payments on retirement benefits to the amount of sick leave accrued as of December 31, 2018.

- Funding Provisions:

- Establishes a statutory calculation and requirement to pay the full ARC (retains current statutory fixed rate as base rate). Additional amount needed to pay off the pension unfunded liability is prorated to each employer based on share of actual payroll in FY15-FY17, with school board payment paid by state appropriation (other employers will be required to pay their share).

- Requires financing of unfunded liabilities over closed 30-year amortization period, using 5-year smoothed asset valuation method for TRS pension fund. Resets amortization period in 2018 valuation.

TRS Retired/Reemployed Provisions: Same provisions as current law except no second retirement accounts in TRS for any member of a state retirement system who retires on or after January 1, 2019.

- Establishes Hybrid Cash Balance Plan for New Members on or after January 1, 2019

- Puts teachers in same type of cash balance plan as KRS but with different contributions.

- Non University Contributions (teachers): Employee (9.105%) and Employer Credit (8%) plus interest credit.

- University Contributions: Employee (7.625%) and Employer Credit (4%) plus interest credit.

- Interest Credit: Contributing members receive 85% of the plan’s 10-yr net return, Former members who have left employment receive 0%.

- Retirement Eligibility: Age 65 w/ 5 years OR Rule of 87 and members may choose to annuitize their account balance at retirement and receive a lifetime payment (same as KRS Nonhazardous cash balance plan).

- Portability: Immediately vested for employee contributions and interest credits on employee contributions. Fully vested for employer credit and investment returns on employer credits after 5 years.

- Voluntary “Opt in:” Members with less than 5 years of service may elect to roll over their accumulated contributions in to the new hybrid cash balance plan.

- Members eligible for retiree health/disability/death before retirement benefits similar to current members. Retired members in the cash balance plan will not receive a cost of living adjustment after retirement or the $2,000 pre-retirement life insurance benefit or $5,000 post-retirement life insurance benefit payable to deceased retired members with at least 5 years service. Sick leave payments do not impact retirement benefits.

- “Inviolable contract” will be limited to account balance in the cash balance plan (same changes were made to KRS, LRP, and JRP in 2013).

Update from Frankfort

March 2, 2018

HOUSE WEEK IN REVIEW

FRANKFORT— Getting two people to agree on an issue can be difficult. Getting up to 100 people to agree on an issue—especially one as complicated as passage of a $22.5 billion budget that affects every single person in the Commonwealth—can be downright impossible.

As a member of the Kentucky House, I can tell you that how a lawmaker votes on the state’s two-year spending plan may come down to just one or two issues. Too little money for public schools can mean a “no” vote for many lawmakers who otherwise support a budget that beefs up funding for prosecutors or social workers. So balance is critical in passing a budget, and balance is what we tried to achieve in this session’s Executive budget bill, House Bill 200, which passed the House by a vote of 76-15 on Thursday.

With Senate passage of this session’s pension reform bill expected any day, HB 200 would increase funding for the Kentucky Retirement Systems by $774.5 million and the Kentucky Teachers’ Retirement System by $89.1 million to meet the state’s full actuarially required contribution (or ARC) for state employee and teacher pensions, with full funding for teacher retirement provided at the school district level. Health coverage for retired teachers through the biennium would be secured with $59.5 million added to this budget which also includes funding for health care for active school system employees.

For our students, HB 200 would boost base per-pupil funding for K-12 education, or SEEK funds, to a record level of $4,055 in the first year of the biennium and $4,056 in the second year. The bill would also provide $7 million in surplus SEEK to fund the emergency revolving loan fund for struggling school districts as directed by this session’s HB 141, and increase school transportation funding to $127.8 million in each year of the budget cycle to restore funding there.

Students headed to college would also benefit from HB 200, which would provide over $105 million to restore higher education funding left out of earlier budget proposals and well over $215 million in KEES scholarship money drawn from Kentucky Lottery proceeds. It would also boost funding for specific programs at state universities.

Support for adoption and foster care reforms in HB 1 that passed the House on Wednesday and is now before the Senate is found in HB 200’s health and family services portion. Over $86 million will be added over the biennium to add 354 positions to reduce worker caseloads under the bill, with another $25 million be added to recruit social workers. Additional funds for community living supports, substance abuse treatment for pregnant women, and millions of dollars over the biennium for the state’s popular Family Resource and Youth Services Centers, or FRYSCs, that help remove barriers to student academic success would also be provided.

We also would increase funding for public safety in this proposal, with particular attention paid to the Kentucky State Police with funding for hundreds of new cruisers and rifles for our state troopers. Increased funding for corrections is included to the tune of around $50 million to accommodate an increase in the state’s prison population. Funding for CASA (Court Appointed Special Advocates for abused and neglected children), day treatment for troubled juveniles, and funds to hire over 50 new public defenders who provide representation for defendants who can’t afford to hire their own attorney would also be funded.

Kentucky prohibits revenue from being included in its spending bills, so the revenue for the next two-year state budget is being approved separately. The funding required to carry out the appropriations in HB 200 is found in HB 366, also approved by the House on Thursday by a vote of 68-25.

Many revenue makers in the bill are the same as in nearly every revenue bill, with some differences. But HB 366 includes some striking new revenue streams, too—most significantly a 50-cent per pack increase in the cigarette tax beginning this July and a 25-cent per dose tax on opioids at the distribution level. Both revenue sources are projected to rake in an extra $377 million over the two-year budget cycle for the Commonwealth. (Other revenue changes in HB 366 would bring in around $123 million in additional revenue over the next two years, for a total of around $500 in new revenue over the biennium raised by the bill.)

One more word on the opioid revenue, which would be tracked by the Office of the Attorney General to ensure the tax isn’t passed on to consumers, according to testimony in the House budget committee. Any repercussions would come from that office, which also had a role in Kentucky’s 2016 consumer protection settlement with Volkswagen. A fund to distribute Kentucky’s share of the settlement—which could potentially bring $100 million to both the state and impacted customers—would be created by HB 366, with around $20 million from that settlement going to fund fuel-efficient school buses for local school districts over the next two years.

Two other budget bills that are important, yet usually receive much less fanfare than the Executive budget and state revenue bill, are the budgets for the Legislative and Judicial branches of state government. They also passed the House on votes of 83-7 and 84-8 respectively.

Now, even those who praise what they consider to the good points in the spending and revenue bills we will pass this session acknowledge that the bills aren’t perfect. HB 200 doesn’t propose to restore all funding cuts in earlier budget proposals, not does it provide all the funding state agencies, universities and local agencies need or want. Then there’s the revenue bill which, although necessary in some form, is not the broad-based tax reform that some in the House want to push through this session.

In short, these bills coming out of this House this week are starting points for possibly something greater by the time this 2018 budget session is over. It’s our hope—for state government and all of Kentucky—that the end result will justify the means by the time our work is finished in April.

Please continue to stay informed of all legislative action during the 2018 Regular Session by reading the daily Legislative Record, which is found on the Legislative Research Commission website at www.lrc.ky.gov. You can also leave comments for your state Representatives and Senators by calling the Legislative toll-free Message Line at 800-372-7181.

Reps. Ken Fleming, Kim Moser’s Bill to Create Confidential Legislative Tip Line to Report Wrongdoing Passes Committee

FRANKFORT, Ky. (March 2, 2018) – On Thursday, a bill that would create a Legislative Tip Line to confidentially report wrongdoing within the legislature, including harassment, discrimination, ethical or official misconduct, theft, and fraud passed the House State Government Committee.

Reps. Ken Fleming, R-Louisville, and Rep. Kim Moser, R-Taylor Mill, are the sponsors behind House Bill 9. The tip line would be directly administrated by the Legislative Ethics Commission, which would have authority to investigate complaints against members of the General Assembly, employees of the legislature, legislative agents, and any other person interacting with members of the General Assembly or employees of the legislature.

“This bill is part of a proactive approach to solve a serious issue,” said Rep. Fleming, who has been a leader on similar efforts in the past, notably during his tenure as a Louisville Metro Councilman.

Other public and private organizations use a tip line such as New York State, City of Portland, Louisville Metro Government, Atlanta Public Schools, and many companies.

The bill would require the Legislative Ethics Commission to ensure the tip line telephone number is available to employees, and accessible 24 hours a day, and seven days a week. Within two hours of receiving a compliant, the executive director of the commission will review the complaint, and will have 24 hours to notify the alleged perpetrator of the complaint and the allegations. Within 30 days of receipt of a complaint and the ensuing investigation, involving interviewing the complainant and perpetrator, the commission’s staff would give a status of the complaint to the commission’s Board and the Director of LRC, including those complaints that were resolved. However, should the commission determine the complaint is not resolved, the commission’s enforcement counsel shall file a complaint under KRS 6.686(1)(a). Should the commission determine a complaint is beyond its jurisdiction, it would be referred to another state or federal agency.

Currently, complaints made by employees of the Legislative Research Commission are reported to the same body that investigates, and which reports to legislative leadership officers. As a result, there is no involvement by an independent, third-party with the ability to level disciplinary actions against any party.

Employees who file complaints via the Legislative Tip Line will be protected from reprisal, including threats and the use of influence to discourage or interfere with any complaint. Annually, the commission will be required to publish a summary of complaints and distribute it to the members of the commission, the director of the commission, each member of the Legislative Research Commission, and the director of the Legislative Research Commission.

The measure now goes to the House floor for consideration.

Update from Frankfort

February 9, 2018

The Pace Quickens; Critical Legislation Moves

REPRESENTATIVE KIM MOSER

In Frankfort, diligent work continues on a pension reform proposal and a responsible budget. As those two issues consume much time and effort, there are also several other critical bills moving through the House.

One measure that is very important to many of our state’s rural counties is House Bill 141, which seeks to establish an emergency loan account for school districts struggling financially to finish the school year, because of extraordinary circumstances that are no fault of their own. Unfortunately, the decline in coal severance revenues and ensuing erosion in local property tax bases have left some school districts in Eastern and Western Kentucky without the funds necessary to educate our students. To help remedy this situation, school districts that meet certain criteria could apply for up to $500,000 in loans from the Kentucky Department of Education.

The loans, which are zero-interest, have the potential to greatly assist coal counties in particular. While this is not a long-term fix, it will help school districts remain solvent in the short-term so they can continue to properly educate students.

With an emphasis on urban areas, House Bill 169 is the first effort in decades to crack down on troublesome gang violence. The bill provides for enhanced penalties for committing gang crimes while also creating a pathway for victims of gang crime to seek civil damages. Cracking down on violent gangs, which often recruit young teenagers, is a vital anti-crime measure that gives our justice system greater ability to protect families and communities.

In Kentucky, the opioid battle rages on, and on. For the second year in a row, I am proud to say the Legislature continues to take tough action to limit the supply of prescription drugs and end the cycle of addiction. House Bill 148 is the latest in the effort, and seeks to require hospice programs to dispose of or remove all controlled substances left behind in the households of deceased patients, if they are given written permission to do so. If they are not granted written permission, the Kentucky State Police would be responsible for removing the drugs.

House Budget Review Subcommittees continue to move line-by-line through the Governor’s proposal, working long hours to produce a budget that is responsible and fully pays our pension contributions, in addition to other necessary government services like education, health care, and transportation. As of now, the goal remains to complete the budget in the House by the end of February, enabling every legislator adequate time to fully review the final document.

Springtime and summer are just around the corner and that means Kentucky kids will knock the dust off their bicycles. However, this year they may have to make sure they pull out their helmets too, based on a bill that received passage in the House this week that would require kids under the age of 12 to wear one when riding a bicycle. House Bill 52, known as “TJ’s Bill,” is the result of seven year old TJ Floyd who suffered a traumatic brain injury at just seven years old when he fell off his bicycle. If passed, the bill would not fine anybody if a child doesn’t wear a helmet, but could prevent more injuries like TJ’s as research suggests helmets are more than 84 percent effective at preventing brain injuries.

Thank you for allowing me to serve as your voice in Frankfort. Please reach out to me with your thoughts on the serious issues we are working on, by email or phone. You can reach me through the toll-free message line in Frankfort at 1-800-372-7181, or you can contact me via e-mail at Kim.Moser@lrc.ky.gov. You can keep track of committee meetings and potential legislation through the Kentucky Legislature Home Page at www.lrc.ky.gov.

This column was produced by House Majority Communications, and made available for House Republican Members to distribute.

***

BREAKING NEWS!

Rep. Tom Kerr Endorses Kim Moser!

“Kim is a proven leader in fighting for the health and well-being of our state and communities…Kim, a fiscal conservative, will build consensus to further our conservative values, and has the heart of a servant leader. This is an important election, and it is my honor to endorse Kim… I encourage you to cast your ballot for Kim Moser on  May 17th.”

May 17th.”

Team Moser Weekly Update

March 2, 2016

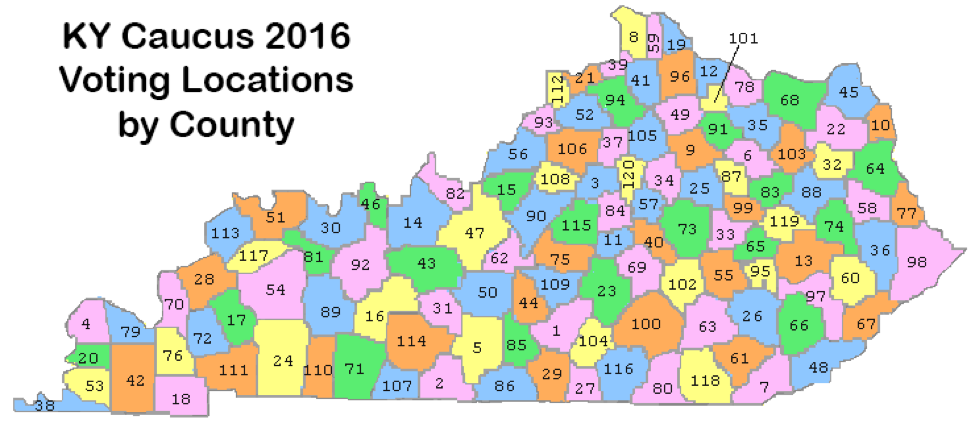

The first “Super Tuesday” and several state caucuses are behind us and Kentucky is marching full-speed toward our first ever Republican Presidential Caucus! Don’t forget to vote this Saturday, March 5. This will be your only opportunity to have a voice in nominating the next Republican Presidential Candidate! YOU WILL STILL VOTE IN THE MAY 17TH PRIMARY ELECTION FOR ALL OTHER RACES!

http://www.55krc.com/onair/brian-thomas-5053/where-do-i-vote-in-kentucky-14434477/

Kim Moser. I am working hard to be your conservative voice in Frankfort! Please join our team today! We will be in your neighborhoods soon, sharing my conservative message and working toward winning on the May 17th Primary! Learn more, donate and share at: www.MoserForKentucky.com or on Facebook: Kim Moser for State Representative.

Chris Courtney, Campaign Manager. Chris is our “go to” person if you want to volunteer in any way! He is available to answer questions and get you the information and campaign materials that you will want to have! Yard signs, bumper stickers and t-shirts are all available! Please send us your sign locations – large and small! Email at chris@moserforkentucky.com.

This week:

- Friday, March 4, 2016:

- Taylor Mill Moose Lodge Fish Fry: 5-8 pm

- Others to attend on behalf of #TeamMoser

- Cecilia Fish Fry: 5 – 8 pm

- Patrick’s Fish Fry:: 5 – 8 pm

- Barbara’s Fish Fry: 4:30 – 8 pm

- #TeamMoser will be at the Moose Lodge (and maybe a surprise appearance elsewhere) this week, but feel free to sport your #TeamMoser shirt at any fish fry in the district! Join us at the Moose Lodge or get your t-shirt and push cards to support us anywhere.

- Saturday, March 5, 2016: REPUBLICAN PRESIDENTIAL CAUCUS 10AM-4 PM. Kenton County votes at Summit View Academy in Independence, KY. Visit RPK.com or our website: http://MoserForKentucky.com for more information.

- MARK YOUR CALENDARS! We are planning a Campaign Headquarters Open House on March 9 from 5 – 7:30 pm: 5294 Madison Pk, Independence. Please stop by and say hello, have some cake and help us kickoff the campaign to WIN on MAY 17TH!

- Make sure that you, your friends and your family are REGISTERED TO VOTE in the May 17th primary election. Here is the link to register at least 29 days prior to the election – http://elect.ky.gov/registertovote.